The Fiscal Year 2023/24 Operating Budget was adopted by the City Council on June 21, 2023:

On June 7, 2023, a Budget Workshop was presented to City Council:

The Preliminary Operating Budget was presented to City Council on May 17, 2023:

The Escondido Discussion continues as the City prepares for the upcoming FY 2023/24 budget adoption, and we want to hear from YOU! The Escondido Discussion is an opportunity to share your local community priorities and City service needs for the upcoming fiscal year.

The City hosted three public workshops presented by staff:

-

Friday, March 31, EVCC Vineyard Room, 6 – 7 p.m.

-

Saturday, April 15, City Hall Mitchell Room, 10 – 11 a.m.

-

Friday, April 21, Virtual Community Alliance for Escondido (CAFÉ), 8 – 9:30 a.m.

-

A copy of the presentation is available here.

You can also participate in the City’s budget process by taking the online survey . . .

About the City's Budget

The City of Escondido adopts its budget each June for the following fiscal year, which runs from July 1 to June 30. The budget, while a financial document, is also an important policy document, outlining the City Council’s priorities for the upcoming year and showing where the City's funds will be allocated.

The

Operating Budget projects short-term revenue and expenditures related to providing day-to-day services. A separate

Capital Improvement Project Budget projects long-term revenue and expenditures for major projects such as roads, park improvements, and pipelines.

The budget process begins around December each year; the City Manager and Finance staff meet to develop the assumptions, guidelines, and schedules to be used in the preparation of the operating budget. The Finance Department provides a budget newsletter to each department, which includes information such as:

-

The City’s current fiscal situation: Current revenue constraints and economic or community conditions

-

Council priorities for the upcoming year

-

Changes affecting the cost of employee wages and benefits

-

Instructions and due dates for completing budget submissions

The City’s operating budget provides a plan for how the monies coming into the City (revenues) will be spent in order to operate and maintain City functions and services, such as police, fire, parks, and libraries.

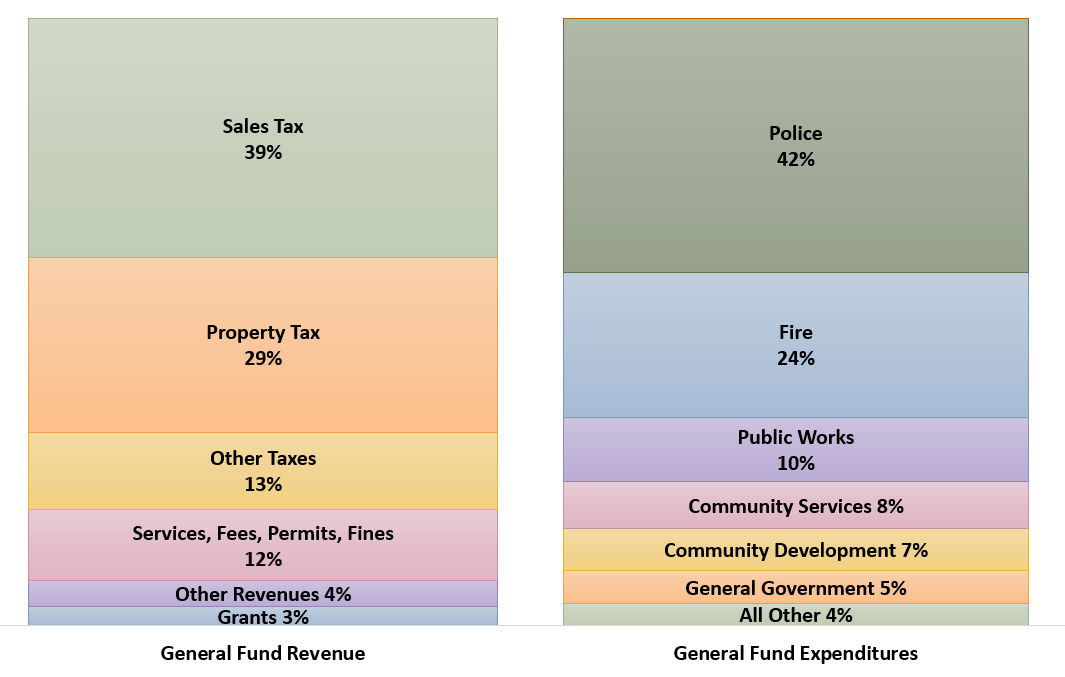

The General Fund is the chief operating fund of the City and accounts for all financial resources except those required to be accounted for in another fund. The City spends 76% of its General Fund departmental budget on public safety, and the remaining on services such as parks, libraries, public works, and general government services. City services require people to provide them, and as a result 85% of the City’s costs are personnel costs.

Core City services funded through the General Fund’s budget are supported by a variety of revenue sources. The four major General Fund revenues are sales tax, property tax, and other taxes which includes transient occupancy tax, business license tax, and franchise fees. Combined these revenues account for 81% of the General Fund’s revenue.

The Fiscal Year 2023/24 Preliminary Operating Budget will be presented to the City Council on May 17, 2023

The Public Hearing for the adoption of the Fiscal Year 2023/24 Operating Budget is scheduled for June 21, 2023*